Redbrick Investment Group completes its first real estate securitisation through the acquisition of a residential building in Milan

30 May 2024

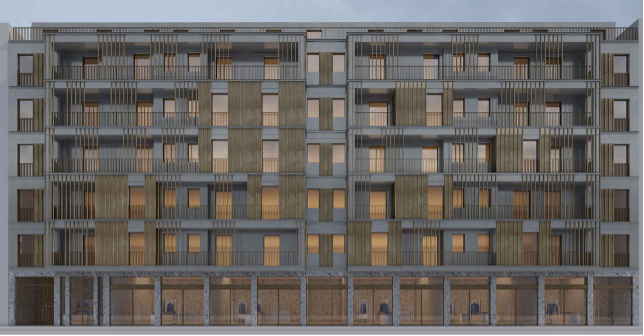

The partners of Redbrick Investment Group –real estate asset and development manager (https://www.redbrickinv.com/), an independent company active in real estate investments in Italy – in partnership with an international alternative investment fund, have acquired a property of approximately 5,000 square meters mainly for residential use in the area of Piazzale Susa in Milan. The property, built in the 1960s and with seven floors above ground, comprises more than sixty residential units and two retail spaces, and is almost entirely leased.The project, developed by Studio BE.ST. of Milan, involves the renovation of all the common areas and the facades with a significant improvement in the energy performance of the building.

The investment has been structured through a securitisation vehicle (art. 7.2L.130/99), in which Redbrick Advisors S.r.l. will have the role of asset manager and Zenith Global that of master servicer. Banca Akros is the arranger of the transaction and Banco BPM acted as senior lender.

Redbrick Investment Group was assisted (i) by the lawyers Filippo Turrio and Andrea Pantanella of Matèria with regards to civil law issues, (ii) by the lawyers Francesco Squerzoni, Marco Frattini and Maddalena Catello of Jones Day, with regards to the issues related to the structure of the securitisation and the relevant financing.Banca Akros and Banco BPM were assisted by partners Luciano Morello and Giampiero Priori and senior lawyers Erik Negrettoand Oreste Sarra of DLA Piper, in the context of the securitisation and the financing.

Alexio Pasquazzo, Founding Partner of Redbrick Investment Group together with Nicola De Martino, declared that "This acquisition represents an excellent opportunity to expand our AUM and to create value for us and our investors. It can be regarded as a virtuous example of energy transition of the real estate stock of the city of Milan and one of the first real estate securitisations in the Italian market. We believe that for this reason it will represent a reference point for the real estate investment market in Italy".